michigan use tax exemption form

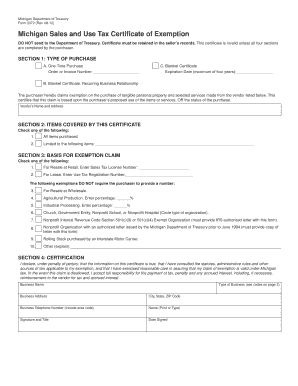

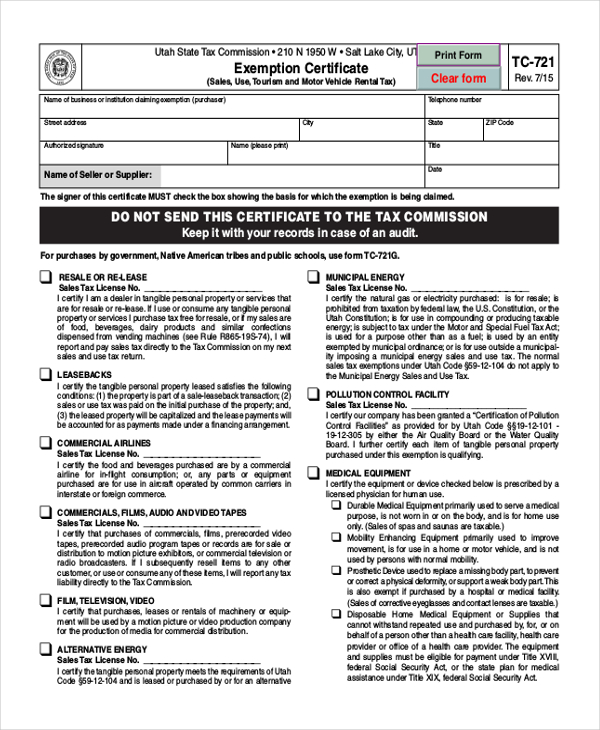

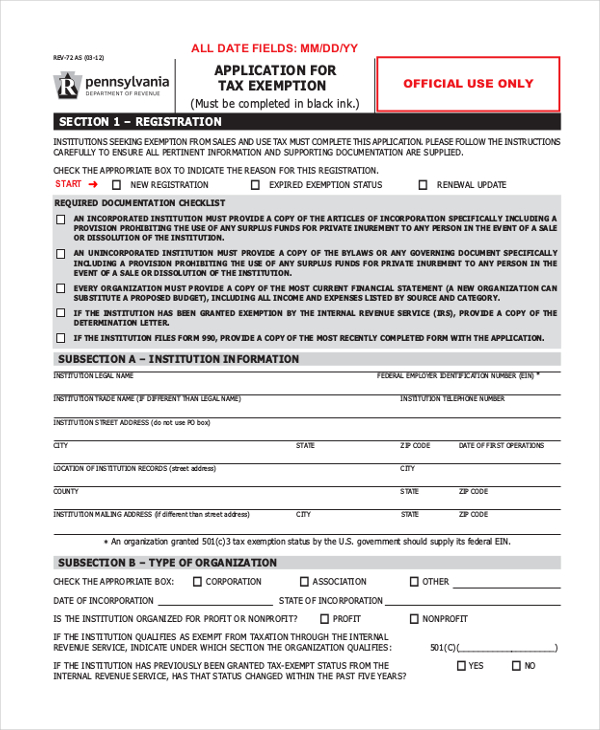

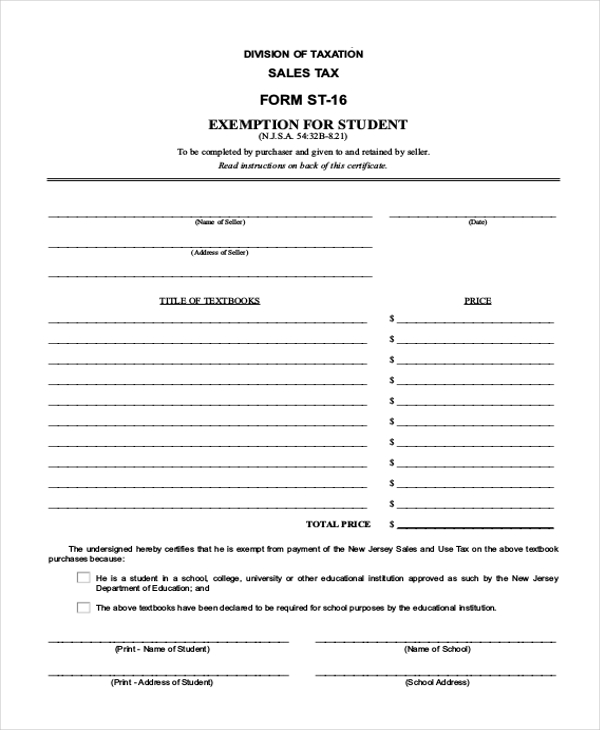

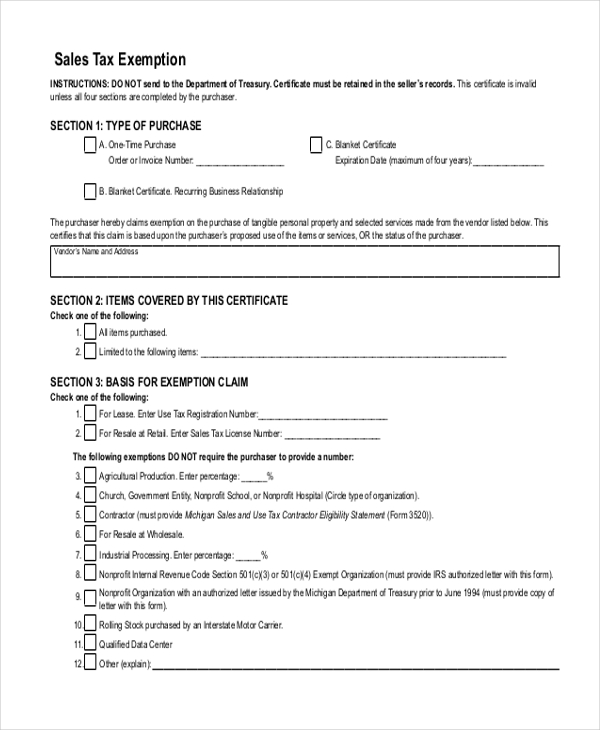

The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form 3372. How to use sales tax exemption certificates in Michigan.

Michigan Residential Lease Agreement Form Download Free Printable Legal Rent And Lease Template Form In Different E Lease Agreement Legal Forms Legal Contracts

This certiicate is invalid unless all four sections are completed by the purchaser.

. All claims are subject to audit. Department of Public Works. TYPE OF PURCHASE One-time purchase.

Michigan Department of Treasury Form 3372 Rev. Obtain a Michigan Sales Tax License STEP 2. Michigan Sales and Use Tax Certificate of Exemption.

OR the purchaser s exempt status. If the retailer is expected to be purchasing items frequently from the seller instead of completing a resale. Fill out the Michigan 3372 tax exemption certificate form.

Michigan does not issue tax exemption numbers. Michigan Business Tax Created Date. All claims are subject to audit.

Sales Use and Withholding Tax Due Dates for Holidays and Weekends. 2020 Aviation Fuel Informational Report - - Sales and Use Tax. For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act.

Steps for filling out the Michigan Sales and Use Tax Certificate Exemption Form 3372 Step 1 Begin by downloading the Michigan Resale Certificate Form 3372 Step 2 Indicate whether the transaction is a one-time purchase or a blanket certificate. Streamlined Sales and Use Tax Project. Producers will note on item 4 in section 3 that you are to indicate the percentage of the purchase item is for agricultural production and that percentage would be exempt from sales tax.

Sales Tax Exemption Michigan Simple Online Application. Please note that while the purchaser is now able to request a refund directly from the Treasury form 5633 has a statement that indicates that the. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Certiicate must be retained in the Sellers Records. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Michigan Department of Treasury Form 3372 Rev.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Do not send a copy to the IRS unless requested. To claim an exemption from use tax an authorized representative of a.

In order to receive the refund the manufacturer must fill out sign and send in Purchaser Refund Request for a Sales or Use Tax Exemption Form 5633 into the Michigan Department of Treasury. This exemption is. This exemption application must be completed by the buyer provided to the seller and is not valid unless the information in all four sections is complete.

Buildings Safety Engineering and Environmental Department. Michigan Department of Treasury 4288 Rev. Either the letter issued by the Department of Treasury prior to June 1994or Your.

Electronic Funds Transfer EFT Account Update. This claim is based upon. 11-09 Michigan Sales and Use Tax Certificate of Exemption DO NOT send to the Department of Treasury.

Sales Tax Return for Special Events. Seller s Name and Address. This page discusses various sales tax exemptions in Michigan.

All fields must be. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from the. Michigan Department of Treasury 3372 Rev.

Civil Rights Inclusion Opportunity Department. Attach a copy of the exemption certificate granted by the Michigan State Tax Commission Qualified Convention Facility Check this box only if the property owner is qualified under the regional convention facility authority act pursuant to the Michigan Sales and Use Tax Acts MCL 20554dm and MCL 20594 z respectively. Michigan Sales and Use Tax Certificate of Exemption.

Sales Tax Return for Special Events. Sellers should not accept a number as evidence of exemption from sales or use. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

Certificate must be retained in the Sellers Records. Tax Exemption Certificate for Donated Motor Vehicle. Download Or Email MI DoT 5107 More Fillable Forms Register and Subscribe Now.

The purchasers proposed use of the property or services. Michigan Sales and Use Tax Exemption Certificate. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed.

All claims are subject to audit. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. 3372 Page 2 Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Purchasers may use this form to claim exemptlon from Michigan sales and use tax on qualified transactionsIt is the Purchasers responsibility to ensure the.

Do not send a copy to Treasury unless one is requested. Ad Sales Tax Exemption Michigan Wholesale License Reseller Permit Businesses Registration. Form 4288 Tax Exemption Certificate for Donated Motor Vehicle Author.

8-09 Michigan Sales and Use Tax Certiicate of Exemption DO NOT send to the Department of Treasury. Notice of New Sales Tax Requirements for Out-of-State Sellers. Electronic Funds Transfer EFT Account Update.

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Michigan Sales and Use Tax Contractor Eligibility Statement. Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied transactions.

Tax Exemption Certificate for Donated Motor Vehicle. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption Evidence of nonprofit eligibility.

Sales Tax Exemptions in Michigan. Ad Fill Sign Email MI DoT 3372 More Fillable Forms Register and Subscribe Now. Michigan Sales and Use Tax Contractor Eligibility Statement.

Therefore you can complete the 3372 tax exemption certificate form by providing your Michigan Sales Tax Number. 01-21 Michigan Sales and Use Tax Certicate of Exemption This exemption claim should be completed by the purchaser provided to the seller and is not valid unless the information in all four sections is complete. Several examples of exemptions to the states.

While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. In order to claim exemption the nonprofit organization must provide the seller with both.

However if provided to the purchaser in electronic format a signature is not required. All claims are subject to audit. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions.

This form an exemption claim for example Form 3372 and an accurate record of the purchase including but not limited to a paper electronic or digital receipt invoice or purchase order related to the sale that includes the date of the purchase and.

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

10 Ways To Be Tax Exempt Howstuffworks

Assignment Sheet Template Beautiful 14 Trademark Assignment Forms Pdf Doc Assignment Sheet Assignments Essay About Life

Https Www Besttaxfiler Com About Php Best Tax Filer Provides Professional Tax Preparation Services Tax Services Accounting Services Tax Preparation Services

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

How To Get A Sales Tax Exemption Certificate In Colorado Startingyourbusiness Com

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

What Is A Sales Tax Exemption Certificate And How Do I Get One

Printable Sample Personal Loan Contract Form Bad Credit Car Loan Contract Template Personal Loans

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

What Is Irs Form 1120 Tax Irs Forms Income Tax

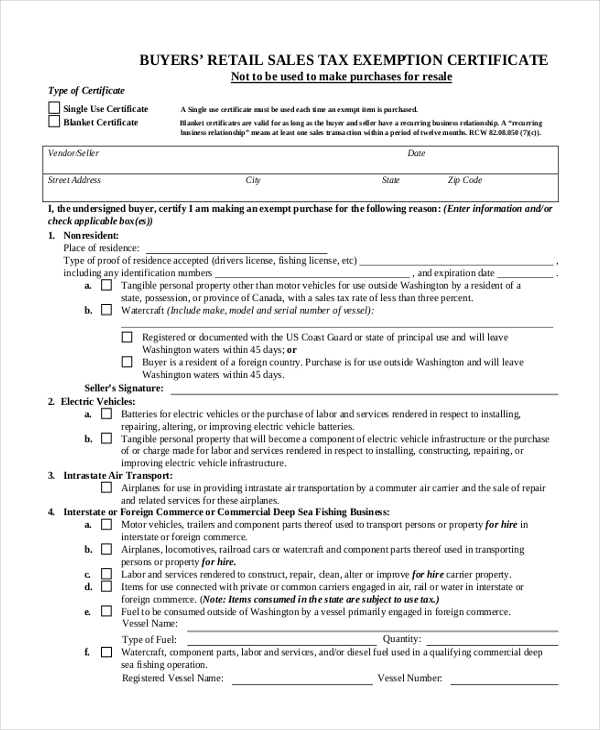

Printable Washington Sales Tax Exemption Certificates

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

Download Policy Brief Template 40 Brief Executive Summary Ms Word

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com